Are Sagging Floors Covered by Insurance? What Homeowners Need to Know

Sagging Floor Insurance Coverage Checker

Does Your Sagging Floor Qualify for Insurance Coverage?

Select the cause of your floor sagging to see if it would likely be covered by standard homeowners insurance.

Results will appear here after selecting a cause and clicking "Check Coverage"

When you notice your floor sloping toward the center of the room, or doors that won’t close properly, it’s easy to panic. Is this a minor settling issue-or a full-blown foundation failure? And more importantly, sagging floors-are they covered by insurance?

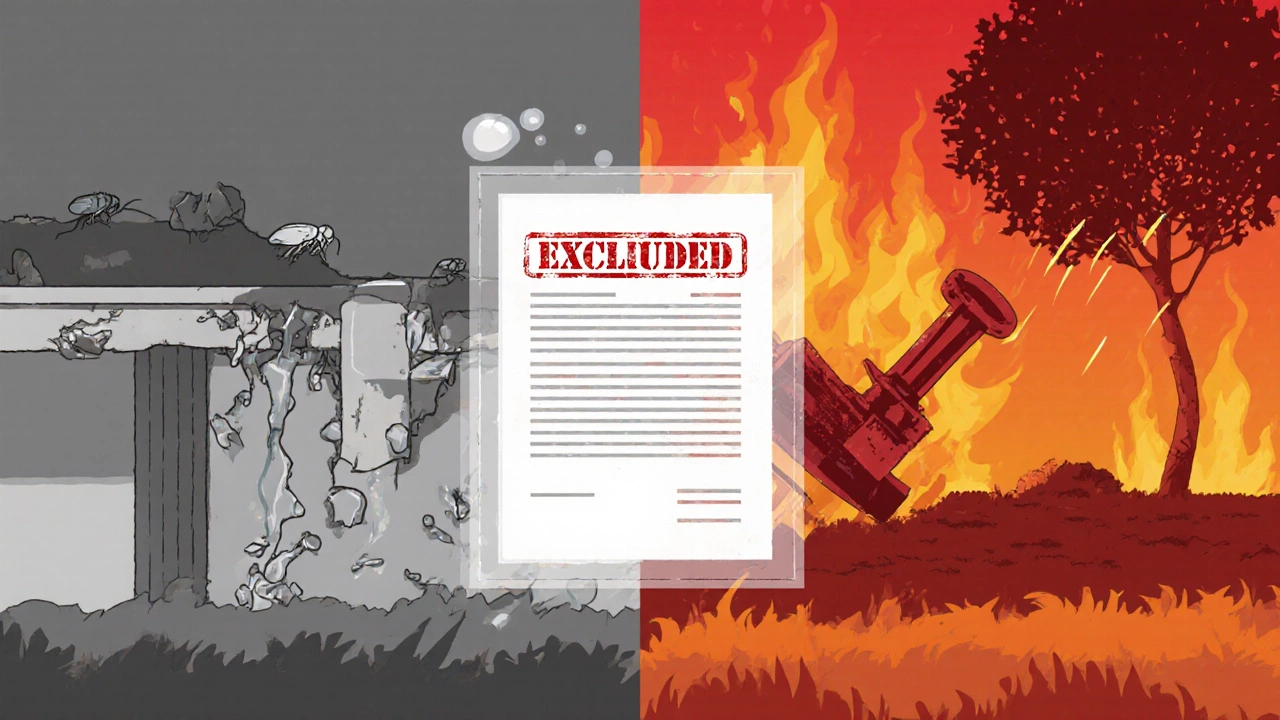

The short answer: usually not. Most standard home insurance policies don’t cover sagging floors unless they’re caused by a sudden, covered peril like a fire, explosion, or falling tree. But that’s not the whole story. Many homeowners get caught off guard because they assume their policy protects against structural problems. It doesn’t. Not unless the cause is listed as a covered event.

Why Insurance Won’t Cover Most Sagging Floors

Insurance companies treat sagging floors as a maintenance issue, not an accident. They’re typically the result of slow, gradual damage-like soil erosion under the foundation, poor drainage, or wood rot from decades of moisture exposure. These aren’t sudden events. They’re things that develop over years, often without visible signs until it’s too late.

Homeowners insurance is designed to protect against unexpected, accidental damage. If your floor sags because the crawl space flooded during a storm and the wooden joists rotted over six months, that’s not covered. But if a tree crashes through your roof during a windstorm, crushes the floor joists, and causes immediate sagging-that’s a different story. The tree impact is the covered peril. The floor damage is just the result.

Even water damage from a slow leak under the house won’t be covered unless it’s tied to a sudden event, like a burst pipe. A dripping pipe that’s been leaking for months? That’s negligence. And insurers won’t pay for that.

What Causes Sagging Floors?

Understanding the cause is the key to knowing whether you’re covered. Here are the most common reasons:

- Foundation settling: New homes settle slightly in the first few years. But if your house is older and the ground beneath it shifts due to clay soil expansion or drought, that’s a slow process.

- Wet or eroded soil: Poor drainage, broken gutters, or landscaping that directs water toward the foundation can wash away support under footings.

- Rotting floor joists: Moisture from leaks, high humidity, or poor ventilation in crawl spaces leads to wood decay. Once joists rot, they can’t hold weight.

- Termite or pest damage: Termites can eat through structural wood silently. If the damage is extensive, floors sag. Some policies cover this-but only if you had regular inspections and reported signs early.

- Original construction flaws: If the house was built with undersized beams, poor footings, or substandard materials, that’s not covered. Insurance doesn’t fix bad workmanship.

Each of these causes is considered preventable or gradual. That’s why insurers classify them as excluded perils. You won’t find them listed in the "covered perils" section of your policy. They’re in the exclusions.

When Insurance Might Cover Sagging Floors

There are rare cases where coverage kicks in. Here’s what to look for:

- Fire or explosion: If a furnace explodes or a gas line ignites and damages the floor structure, the resulting sagging is covered.

- Wind or hail damage: A storm that tears off part of your roof and causes the floor to collapse under the weight? Covered.

- Vandalism or theft: If someone breaks in and intentionally damages support beams, that’s covered.

- Sudden water damage from a burst pipe: A pipe bursts in the basement and floods the crawl space overnight, causing immediate structural damage. That’s covered-unless you ignored previous leaks.

- Tree impact: A tree falls on your house during a storm and crushes part of the floor. Covered.

Even in these cases, you’ll need proof. Take photos immediately. Save receipts for temporary repairs. Document everything. Insurance adjusters will want to see that the damage was sudden and caused by a covered event-not something that’s been worsening for years.

What About Sump Pump Failure or Sewer Backup?

This is a common point of confusion. Standard policies don’t cover water damage from sump pump failure or sewer backup. But you can buy endorsements-add-ons-to your policy that include this coverage. If your sagging floor is caused by a backed-up sewer line flooding your basement and rotting floor joists, and you have this endorsement, you’re covered.

Same goes for sump pump failure. If your pump dies during a heavy rain and water floods the crawl space, you’re out of luck unless you added water backup coverage. This endorsement usually costs $100-$300 extra per year and is worth it if you live in a flood-prone area.

What You Should Do If Your Floor Is Sagging

Don’t wait. Sagging floors don’t fix themselves. They get worse. Here’s what to do:

- Document everything: Take clear photos and videos of the sagging, cracks in walls, sticking doors, and any visible damage in the crawl space or basement.

- Call a structural engineer: They’ll inspect the foundation, joists, and support system and give you a written report. This is critical for insurance claims and future repairs.

- Review your policy: Look at your declarations page. Check for exclusions related to "settling," "earth movement," or "gradual damage."

- Contact your insurer: Even if you think you’re not covered, report it. Sometimes, if there’s a recent storm or other event, the adjuster might find a covered cause you missed.

- Get repair estimates: You’ll need them whether you’re filing a claim or paying out of pocket. Get at least two bids.

Many homeowners delay because they’re afraid of the cost. But ignoring sagging floors can lead to complete structural failure. Floors can collapse. Walls can crack. The cost to repair a minor sag is $3,000-$7,000. A full foundation replacement? $20,000-$50,000.

How to Protect Yourself in the Future

You can’t always prevent sagging floors, but you can reduce the risk:

- Keep gutters clean: Water running down the side of your house seeps into the soil near the foundation. Clean them twice a year.

- Grade your yard: The ground should slope away from your house by at least 6 inches over 10 feet.

- Install a dehumidifier in the crawl space: Moisture is the #1 enemy of wooden floor systems.

- Get annual pest inspections: Termites and carpenter ants are silent destroyers.

- Consider adding water backup coverage: It’s cheap and could save you tens of thousands.

- Buy a home warranty: Some cover structural components like floor joists if they fail due to normal wear. It’s not insurance, but it helps with repairs.

What Happens If You’re Denied Coverage?

Most claims for sagging floors get denied. That’s normal. But if you believe the damage was caused by a covered event, you can appeal. Gather your engineer’s report, photos, weather reports from the time of the event, and any maintenance records.

Some states have insurance ombudsmen who can help mediate disputes. If your insurer denies your claim without proper investigation, you can file a complaint with your state’s department of insurance. They’ll review whether the denial followed state regulations.

But be realistic. If the damage is clearly due to age, neglect, or slow deterioration, the insurer is within their rights to deny it. Don’t waste time fighting a losing battle. Focus on fixing the problem.

Alternatives to Insurance for Paying Repairs

If insurance won’t cover it, here are your options:

- Home equity loan or line of credit (HELOC): Use your home’s value to borrow money. Interest rates are low, and you can repay over 10-15 years.

- Cash-out refinance: Refinance your mortgage for more than you owe and take the difference in cash. Good if you have equity and want lower rates.

- Personal loan: Faster than a HELOC, no collateral needed. Rates are higher, but you can get approved quickly.

- Payment plans from contractors: Many foundation repair companies offer 0% interest financing for 12-24 months.

- Government grants or low-interest loans: Some cities or states offer aid for low-income homeowners with structural issues. Check with your local housing authority.

Don’t let the cost stop you. A sagging floor isn’t just an eyesore-it’s a safety hazard. The longer you wait, the more expensive it gets.

Is sagging floor damage covered by homeowners insurance?

Generally, no. Most home insurance policies exclude damage from gradual issues like foundation settling, wood rot, or soil erosion. Coverage only applies if the sagging was caused by a sudden, insured event like fire, storm damage, or a burst pipe.

Can I get insurance to cover foundation repair?

Standard policies won’t cover routine foundation repair. But if the damage was caused by a covered peril-like a fallen tree or explosion-you may be covered. You can also add endorsements for water backup or sewer backup, which sometimes relate to foundation issues.

Will termites cause my floor to sag, and is that covered?

Yes, severe termite damage can weaken floor joists and cause sagging. Most standard policies exclude termite damage because it’s considered preventable with regular inspections. However, if termites caused a sudden collapse during a covered event (like a storm), some coverage might apply-but it’s rare.

How much does it cost to fix a sagging floor?

Minor repairs like adding support jacks or sistering joists cost $3,000-$7,000. Major foundation repairs, including underpinning or full slab replacement, range from $15,000 to $50,000 depending on the size of the home and extent of damage.

What should I do first if I notice my floor is sagging?

Take photos, call a structural engineer for a professional assessment, and review your insurance policy. Don’t attempt DIY fixes. Early intervention can prevent a small issue from becoming a full structural failure.