Richest General Contractor in 2025: Who Leads the Construction Industry?

Construction Wealth Index Calculator

Calculate a contractor's wealth index using the methodology from the article: Net Worth + (Revenue ÷ 10)

Wealth Index Result

Your calculation shows a wealth index of

When you look at the global construction market, Bechtel Corporation is a privately held American engineering, construction, and project management company, widely considered the richest general contractor. If you’re wondering who the richest general contractor is, the answer points to Bechtel, thanks to its massive project portfolio, family‑owned equity structure, and consistent revenue streams that dwarf most rivals.

Why "richest" matters in the construction world

We use the term “richest” to refer to estimated net worth or total equity value, not just annual revenue. Net worth captures the cash, investments, and assets a firm controls after liabilities, giving a clearer picture of financial muscle. For a general contractor-one that manages the entire building process-having deep pockets means it can secure large bonds, attract top talent, and weather market swings.

Methodology: How the wealth ranking was built

To rank the firms we combined three data sources:

- 2024 audited revenue figures from company filings and industry reports (e.g., Engineering News‑Record).

- Estimated net worth from Bloomberg, Forbes, and private‑equity analyses. For private firms we used the latest valuation from investment rounds or sale transactions.

- Ownership structure: privately held families often retain more equity than publicly traded firms that dilute shares.

We then calculated a simple wealth index: Net Worth + (Revenue ÷ 10). The divisor smooths revenue impact, focusing the score on long‑term asset value.

Top five general contractors by wealth (2024‑2025)

Below is a snapshot of the biggest players. All figures are in U.S. dollars.

| Company | 2024 Revenue (Billion) | Estimated Net Worth (Billion) | Notable Projects | Ownership |

|---|---|---|---|---|

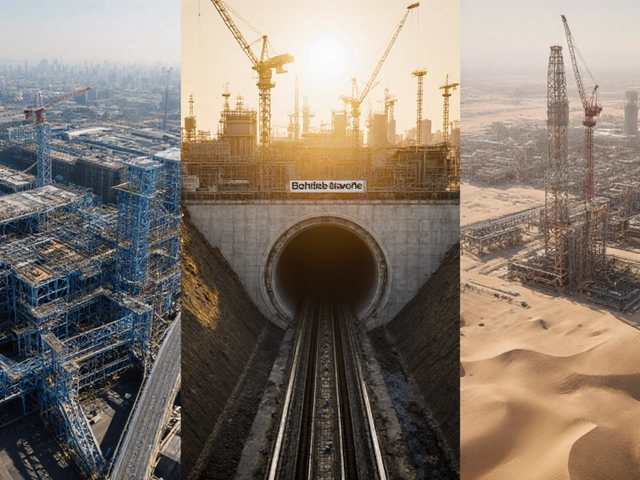

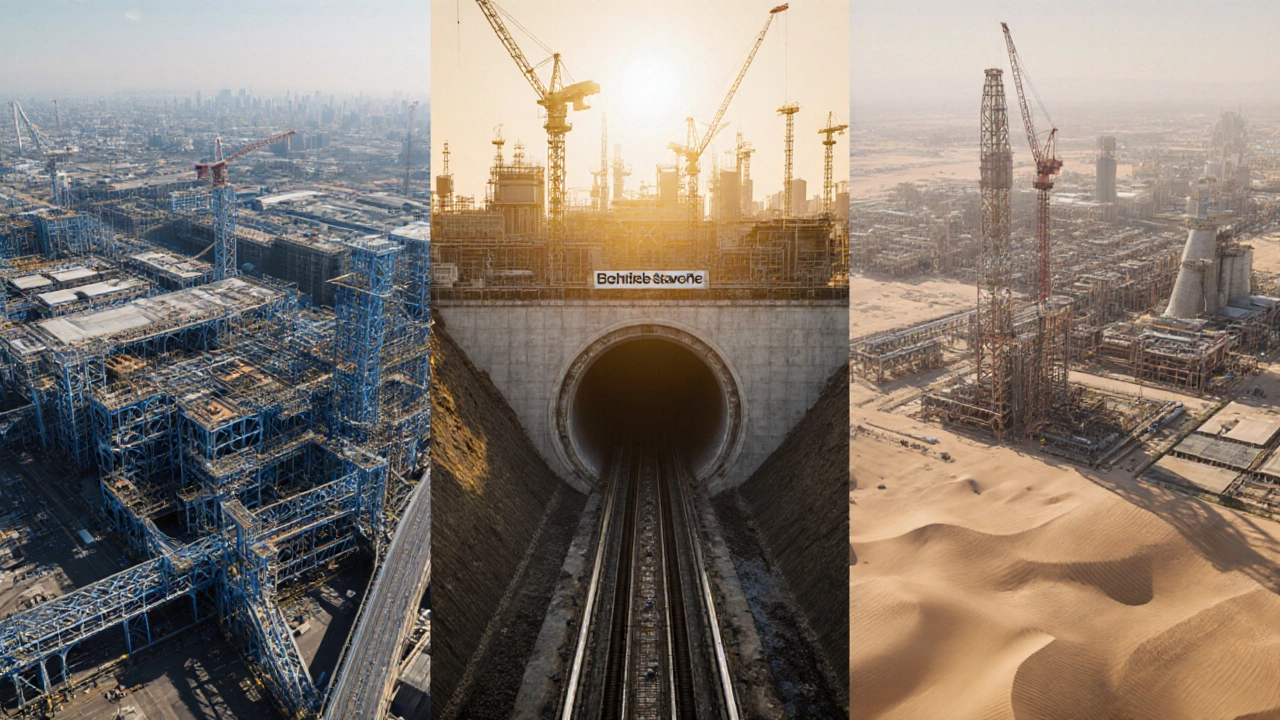

| Bechtel Corporation | 25.5 | 78 | London Crossrail, Los Angeles International Airport, Saudi Aramco Petrochemical Complex | Family‑owned (Bechtel family) |

| Fluor Corporation | 20.1 | 22 | Jeddah Tower, NASA Kennedy Space Center, Singapore MRT | Public (NYSE: FLR) |

| Turner Construction Company | 14.8 | 13 | Hudson Yards, Yankee Stadium, I-495 Reconstruction | Private (H. N. M. Turner family) |

| Skanska AB | 12.0 | 11 | La Fortune Tower (Dubai), Oslo Opera House, New York Penn Station Upgrade | Public (STO: SKAB) |

| Kiewit Corporation | 10.5 | 9.5 | Grand Coulee Dam, Dallas Northwest Elevated, California High‑Speed Rail | Private (Kiewit family) |

Why Bechtel tops the list

Bechtel Corporation outpaces rivals for three core reasons:

- Private equity pool. Because the Bechtel family retains full ownership, the firm can reinvest profits without public‑market pressure, growing its net assets dramatically.

- Global project footprint. From megaprojects in the Middle East to high‑speed rail in the United States, Bechtel’s contracts often exceed $10 billion, providing huge cash flow and long‑term asset accrual.

- Diversified services. In addition to traditional construction, Bechtel offers engineering, procurement, and construction‑management (EPCM) services, meaning it captures value at every project stage.

These factors translate into an estimated net worth of roughly $78 billion-well above the $22 billion valuation of the next‑most‑valuable rival, Fluor.

How the other giants compare

Fluor, the largest publicly traded general contractor, relies heavily on government contracts and large‑scale industrial projects. Its net worth is lower because shareholders own a significant portion of equity. Turner commands a solid reputation in North‑American commercial work, but its revenue base is smaller and it remains privately held with limited cash reserves.

Skanska’s strong presence in Europe and the Nordics gives it steady income, yet its public‑stock structure caps internal capital growth. Kiewit, while a massive player in heavy civil works, stays regionally focused, limiting its global asset portfolio.

Future outlook: Will Bechtel stay on top?

Several trends could reshuffle the wealth hierarchy in the next decade:

- Infrastructure stimulus. Governments in the U.S., EU, and Asia are earmarking over $1 trillion for infrastructure upgrades. Companies with strong capital-chiefly Bechtel and Fluor-are positioned to win the bulk of those contracts.

- Green construction. Climate‑focused projects (e.g., offshore wind farms, carbon‑capture plants) demand specialized engineering. Firms that invest early in sustainable tech can add high‑margin assets to their balance sheets.

- M&A activity. Private firms like Kiewit may seek public partners to raise cash, while public firms could be targets for private‑equity buyouts.

Given its massive cash reserves and diversified pipeline, Bechtel is likely to retain the title of richest general contractor through 2026, unless a surprise spin‑off or major acquisition shakes the market.

Quick guide: How to gauge a contractor’s financial strength

If you’re evaluating a contractor for a big project, keep an eye on these three metrics:

- Bonding capacity. This reflects the amount a surety company will back the contractor’s work-higher is better.

- Net worth / equity. Shows the firm’s ability to absorb losses and invest in equipment.

- Revenue streak. Consistent multi‑year revenue growth signals robust pipelines and client confidence.

Cross‑checking these figures against public reports or a credit agency’s rating can save you from costly overruns.

Frequently Asked Questions

Which general contractor has the highest revenue?

Bechtel posted $25.5 billion in revenue for 2024, making it the highest‑earning general contractor worldwide.

How is net worth different from revenue for construction firms?

Revenue measures the total income earned in a year, while net worth (or equity) equals total assets minus liabilities, reflecting the company’s long‑term financial cushion.

Can a publicly traded contractor ever be richer than a private one?

Yes, if its market capitalization plus retained earnings surpasses a private firm’s equity. However, many private firms (like Bechtel) retain most profits, often outpacing public peers in net worth.

What are the biggest risks to a contractor’s wealth?

Major risks include cost overruns on flagship projects, regulatory changes that affect large infrastructure work, and macro‑economic downturns that shrink public‑sector spending.

How can a small developer assess a large contractor’s financial health?

Ask for a copy of the contractor’s latest audited financial statements, review bonding capacity certificates, and consult credit rating agencies like Moody’s or S&P.